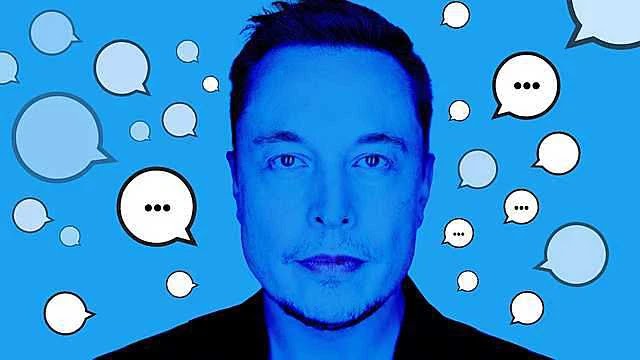

Will Elon Musk continue to buy Twitter shares, sell them all or build his own social network when rejected?

The question that has been frequently asked by those with the most connections in Silicon Valley and Wall Street lately is what Elon Musk will do next when it comes to Twitter’s troubles. Will this billionaire continue to buy shares, sell them all, or is it all just media play?

Twitter’s board of directors said on April 15 that it had approved the “poison” strategy, a move that public companies have used since the 1980s to protect themselves from encroaching investors like Musk.

The Tesla CEO proposed to buy back Twitter for $54.2 per share, which equates to a valuation of this social network at about $43 billion, and the “poison” strategy that Twitter uses is to show that the board thinks it is an offer that is not attractive enough. The price offered by the 50-year-old billionaire is about 38% higher than the price at the time Musk revealed his stake in Twitter. However, it is nearly a quarter of the value of this token in July 2021.

Based on conversations with analysts who have been working at Twitter, Forbes makes some predictions about possible scenarios.

Musk will buy more Twitter shares

Speaking at a TED conference on April 14, billionaire Musk confirmed he had a plan B for Twitter, and said the price of $54.2 per share was his best and last offer. . This means that it is possible that Musk, the richest man in the world, could continue to lower prices.

Elon Musk will need to sell Tesla stock or take out a loan to buy back Twitter. He said he hired Morgan Stanley to advise on this deal.

In fact, Musk’s proposal received a lot of support on Twitter. A significant number of Wall Street analysts, who regularly monitor the social network’s share price, also consider it an attractive offer.

Musk will sell off Twitter shares

Elon Musk’s offer to buy Twitter could be a media game. The Tesla CEO has made fun of himself, and Twitter stock has also rallied. If Musk slowly and cautiously sold the shares he bought, the billionaire would probably make a profit of $500 million or more. That’s also not a bad profit.

Musk will buy more Twitter shares

Speaking at a TED conference on April 14, billionaire Musk confirmed he had a plan B for Twitter, and said the price of $54.2 per share was his best and last offer. . This means that it is possible that Musk, the richest man in the world, could continue to lower prices.

Elon Musk will need to sell Tesla stock or take out a loan to buy back Twitter. He said he hired Morgan Stanley to advise on this deal.

In fact, Musk’s proposal received a lot of support on Twitter. A significant number of Wall Street analysts, who regularly monitor the social network’s share price, also consider it an attractive offer.

Musk will sell off Twitter shares

Elon Musk’s offer to buy Twitter could be a media game. The Tesla CEO has made fun of himself, and Twitter stock has also rallied. If Musk slowly and cautiously sold the shares he bought, the billionaire would probably make a profit of $500 million or more. That’s also not a bad profit.

Musk will form a Twitter acquisition team

The Tesla CEO can partner with one or several other wealthy people, or with an organizer like a holding company. Sharing the financial burden in this way means that Musk doesn’t need to sell Tesla stock or take on huge debt. At the same time, it will also respond to a series of criticism surrounding Musk’s offer to buy Twitter. Earlier, Twitter investor Fred Wilson argued that one of the most crowded social networks on the planet should not be owned by one person, one single force.

Musk will have to compete to buy Twitter but Twitter still doesn’t want to sell himself

Maybe Musk isn’t the only one to suggest buying Twitter in the near future. According to the New York Post, the Thoma Bravo joint stock company of billionaire Orlando Bravo is actively considering making an offer to buy this social network. Twitter was also a target of Elliott Management before they decided to buy a part of the shares in 2019.

Twitter finds a ‘white knight’

The “poison” strategy is one of the common defenses against an investor looking to take control of a company. But there is another way, for the company to find an acquirer that it prefers, who will keep the company’s current management and trajectory. This could happen if Musk continues to buy shares of Twitter and put pressure on the company’s management. It also happens if Musk leaves and another unwanted buyer arrives.

Twitter seems to think this is not going to end. That is why after hiring Goldman Sachs as an advisor, they are said to hire another bank, which is JPMorgan.

Musk built his own social network

Musk may be tired of messing with Twitter, but the billionaire is determined to make his vision of free speech a reality. The Tesla CEO once said that Twitter and other social networking platforms are treating the content on them unfairly. Musk could use his huge capital to create a social media platform of his own, to compete with others like former US President Donald Trump’s Truth Social.

However, this is the least likely scenario, as Truth Social itself is struggling to build a Twitter-like competitor from the start. Morningstar analyst Ali Mogharabi said: “If Elon Musk can indeed raise $43 billion in cash to buy Twitter, he might as well consider creating a new media platform if rejected.” .

فرویزافغان

Thankyu