Anyone may find ways how to be a Forex trader thanks to the availability of trading platforms, cutting-edge computer systems, a wealth of teaching materials, and lightning-fast streaming technology. While anybody can trade currencies at the push of a button, only those with the necessary expertise and understanding have what it takes to consistently earn from their trades. Your ability to trade successfully depends on a number of factors, including control, discipline, and good trading habits; without these, you risk losing all of your money before you establish the proper routines, you should close your trading account or give up.

How to be a Forex Trader in 7 steps

1. Find a Reputable Forex Broker

Finding a trustworthy Forex broker with competitive trading conditions, cutting-edge trading platform technology, and top-notch customer support is the first step to become a day trader. Additionally, it’s critical that the broker you choose offers trustworthy account features like minimal spreads, quick execution, and negative balance protection.

2. Understanding of working capital

Due to the ability to trade on margin, Forex traders do not need a large amount of capital to get started. The amount needed in your trading account to open a position is indicated by this. To open a $300,000 stake, for instance, $3,000 in margin is needed with a 1% margin. The minimum deposit required by some Forex brokers to open an account and begin trading is $50. Keep in mind that the bigger your deposit, the less influence a loss will have on your trading account.

3. Demo trading first

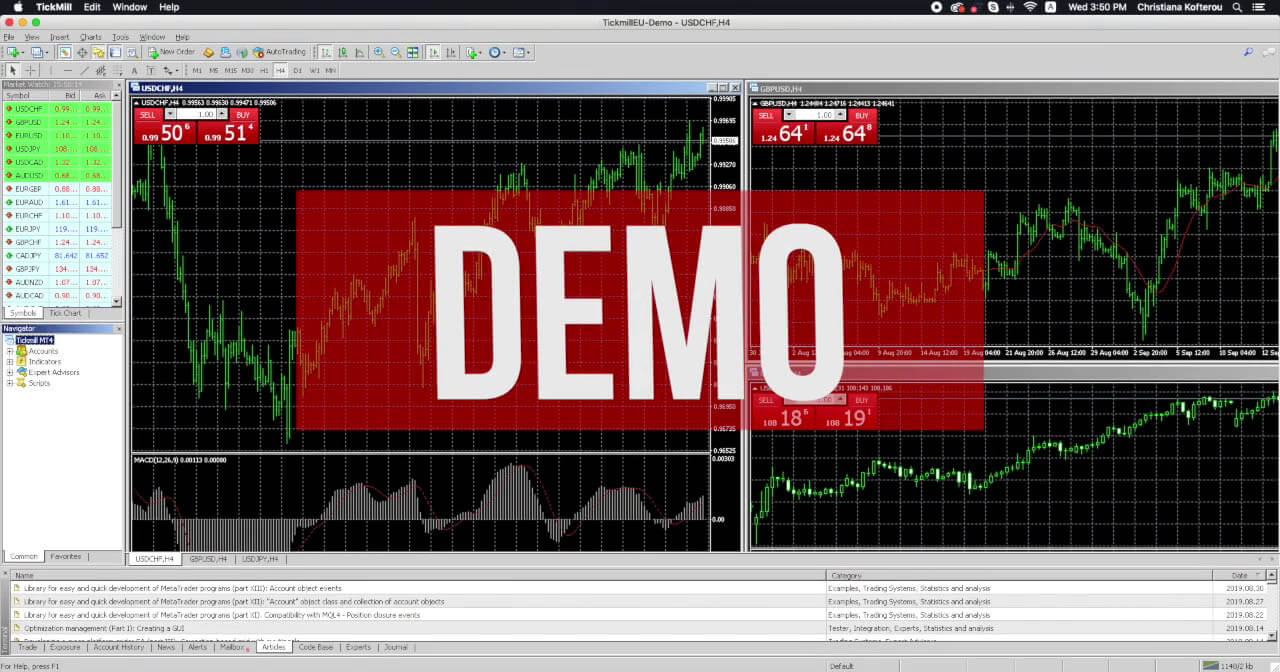

You should start trading if you want to learn how to trade successfully on a regular basis. This allows you the chance to create your trading strategy, continuously practice it, and boost your trading confidence. Additionally, now is a great time for you to get comfortable with the trading platform and learn how to use it.

You can learn what it’s like to lose money when trading in a demo account to get a sense of how you would respond in real-world trading. You’ll get a taste of what it’s like to suffer losses and get to put your risk-management plan to use.

Time spent on demo trading shouldn’t be rushed. A large amount of time should be spent trading on a trial account, and traders should ensure they are consistently making a profit. Although it can be tempting to jump right into live trading, spending some time honing your skills on a demo can truly pay off.

4. Educate yourself

A strong foundation in Forex trading education is necessary if you want to trade the Forex market successfully. You need to learn as much as you can about the market and realize that learning never ends once the demo trading session is over.

Following a trade advisor or coach is a highly effective approach to lower the likelihood of experiencing repeated losses. You can learn how to be a Forex trader by following the advice and teachings of a professional trader and using the right trading techniques and mentality.

You should also utilize the numerous tools and resources that your Forex brokers have to offer, including articles, video tutorials, online seminars, and more. The forex education department at OctaFX is stocked with helpful materials and lessons on how to trade the markets. Utilize technical assistance and on-site trading to the fullest extent possible to enhance your strategy and reduce errors.

5. Start with small steps

Start small and work your way up if you want to become a day trader. Use the approach you are most comfortable using and an amount you can afford to lose after practicing for a few months on a demo trading account.

Start trading with OctaFX MT4, be aware of your risk tolerance, and control your urges to act out of fear, greed, or hope. Be careful when using leverage and be aware of the dangers of using it excessively. To match your trading level and style, OctaFX offers a variety of account kinds. If you are a novice trader, you can select the OctaFX MT4 account type. If you are a more seasoned trader, you can select the OctaFX MT5 account type. You can open an OctaFX cTrader account if you’re seeking for conditionsECN trading.

6. Always trade Forex with discipline

An essential component of trading Forex online is discipline. You must carry out stop loss and take profit orders to defend against unanticipated market reversals and reduce risk if you want to be a consistently winning day trader. Before making any trades, they should be predefined, and they should only be executed after thorough market research.

Additionally, you should strictly adhere to your trading plan and keep a trading diary to track your trading information. This provides a historical perspective and a summary of all your transactions.

The trading diary is an excellent resource since it demonstrates how well your trading strategy performs in various market scenarios. You will get more confidence and learn to trade with discipline by keeping track of your trading record. Do not be concerned when a loss occurs because it is quite tough to make a profit from every trade you do. Instead of attempting to manipulate the market, take control by adhering to a plan and strategy and keeping a journal of your trades.

7. Trade currency pairs that suit your trading style

The Forex market provides traders with fantastic chances as it is the biggest and most liquid financial market in the world. In light of this, it’s crucial that you are entirely at ease and confident when trading your chosen currency pairs, as well as having a thorough understanding of them. Try out other currency pairs on your account since while one person may find one currency pair to be simple to trade, another person may find that same currency pair to be quite stressful. To determine what suits your trading style, try a demo first.

To be informed of the most recent economic developments and Forex news alerts, use the economic calendar. In order to correctly recognize patterns and forecast future price movements, if you enjoy performing technical analysis, make sure you are familiar with the technical indicators you have picked.

The final thought

To increase your chances of profiting from your trades, you should follow the above advice if you want to learn how to be a Forex trader. Online Forex trading offers traders the chance to generate a healthy return on their investment, but it should only be undertaken by those with extensive market knowledge, training, and expertise. Along with having confidence in the trading platform, you also need to be able to handle pressure well and refrain from trading impulsively.

Please read: https://sinhmmo.net/2022/07/what-do-investment-banking-analysts-do.html