TD Ameritrade platform offers one of the most comprehensive trading platforms available anywhere. They offer a full range of investment options, on a modern trading platform, including virtually any instrument, calculator or source of information that you will need to be a successful trader. For US investors and traders, TD Ameritrade’s thinkorswim platform offers a sophisticated multi-asset desktop experience optimized for stock trading, including forex trades. exchange and foreign exchange and futures contracts (including Bitcoin). And in today’s article, let’s find out what TD Ameritrade platform is as well as evaluate TD Ameritrade platform floor in detail with Forexsfxgroup.

What is TD Ameritrade Platform?

TD Ameritrade platform is a forex and CFD trading broker. began in 1975, when the Securities and Exchange Commission (SEC) eliminated the practice of fixed brokerage commissions. That was the beginning of the bearish brokerage wave. One of these companies was First Omaha Securities, which would eventually become TD Ameritrade platform. Since then, TD Ameritrade has been one of the most innovative brokerages on Wall Street.

The company has maintained its focus on self-directed investors since the late 1990s. Since that time, they have worked to improve online trading and were among the first to offer it. online ordering options and e-commerce confirmation by email. They also take the lead in rolling out deals that last several hours.

The name TD Ameritrade platform really came about in 2006, when Ameritrade purchased TD Waterhouse USA, forming one of the largest discount brokerages in the country and the largest in terms of average client trades placed per day.

The company has improved its trading platform, expanding its services to active traders by adding complex options, futures and forex trading. They also started offering mobile apps in 2010.

License to operate

According to headquarters managed by the CFTC, TD Ameritrade Futures and Forex LLC, TD Ameritrade remains one of the few regulated trading firms that still offer retail forex trading in the United States. The brand continues to benefit from the support of the parent company when it comes to technology innovation and customer support. In 2018, TD Ameritrade joined a group of prominent tech investors in a financing round to purchase shares of ErisX, an upcoming crypto currency exchange.

Types of accounts on TD Ameritrade platform

TD Ameritrade offers a Standard taxable investment account, which can be held individually or as a joint account. Retirement accounts include Traditional and Roth IRAs as well as rollover IRAs. They offer education accounts including various state 529 plans, tax-free Coverdell plans, or UGMA and UTMA accounts. They also offer special accounts, including individual trusts and retirement plans (Solo 401(k), SEP and SIMPLE IRAs and Profit Sharing) for business partners and owners. sole property.

Trading Platform on TD Ameritrade

Thinkorswim

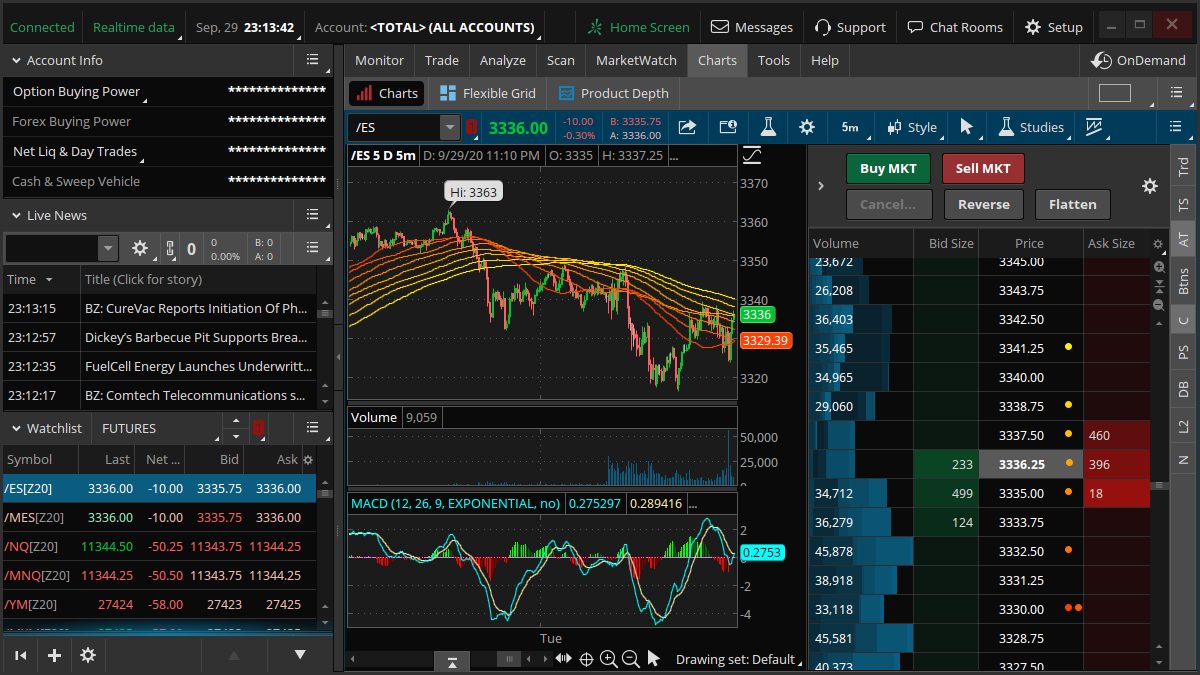

The Thinkorswim platform from TD Ameritrade platform is packed with powerful research tools, including a detailed screener, such as Stock Hacker, and live CNBC news sources in addition to additional 3rd party sources. such as Dow Jones, Thomson Reuters and Morningstar.

There is also a detailed economic calendar and fundamental analysis tools that provide traders with a wide range of means for market research, including video format. One feature I find useful for fundamental research is the FRED Data, which includes historical data on interest rates and other economic indicators that affect monetary policy and money markets.

In addition to the basic features commonly found in an economic calendar, Thinkorswim also adds smart features such as the ability to filter the calendar based on different news events and even set alerts about related upcoming events. to your investment portfolio. Many in-house and third-party social features are also found on the platform, including the Social Signals Insights service from Twitter, in addition to a vast range of research and content. provided by TD Ameritrade platform.

Thinkorswim is available for Windows, Linux and Mac operating systems. After installing Thinkorswim on MacOS, it quickly became apparent that the platform has many tools and features accessible in menus and submenus. For my review, I focus mainly on the specific function of forex.

Instead of grouping all products into the same area, Thinkorswim separates them into individual tabs, making trading streamlined and efficient. According to the Forex Trader module, the rates are displayed for 6 default currency pairs. Users can choose from 75 different forex pairs, and each pair lives in its own module that can be further customized.

In each forex quote window, there is a sidebar that allows you to quickly show or hide different views just for that currency pair. While the feature was difficult to use at first because of the quick adjustment layout, I quickly got the hang of it and found the extra layer of customization a net benefit. Also, if 6 pairs is enough for you, you can easily adjust the grid to accommodate up to 24 pairs at a time in a 4×8 configuration.

Going to the chart section, I was impressed to find almost 400 technical indicators – by far the most in the industry. Without question, technical analysis enthusiasts will quickly love the endless depth available to them, including the ability to use thinkScripts for algorithmic trading, as well as the ability to create push notifications and alerts reported on each indicator. In addition to candlestick patterns, there is an editor that allows users to create their own custom candlestick patterns, a rare feature that candle enthusiasts will appreciate.

If there is enough access to 400+ metrics, each metric can be customized then grouped and saved as sets. Since our last review, the metrics have been grouped by category and are available from a shortcut in the chart, making them easier and faster to access. Furthermore, using the thinkScripts tool, you can modify and create new indicators, which are functionally similar to custom indicators in the MT4 platform or the JForex3 platform from Dukascopy.

Besides powerful charts, heatmap is another highly configurable tool that allows you to explore different metrics and sectors in amazing detail. It’s conveniently located in the watchlist module so you can create custom lists and heatmaps based on items already on your watchlist.

All in all, the number of positive features in the Thinkorswim platform far outweighs any negative attributes. Platforms take time to learn; However, a lot of the tools and depth are well worth the patience it takes. TD Ameritrade platform comes in 2nd place in the Platforms & Tools category in our Forex Review 2019.

Mobile trading

The Thinkorswim mobile app, available for iOS and Android devices, is packed with features, from charts with hundreds of indicators to advanced Blast order creation, all neatly organized in a modern way. , user-friendly.

Conclusion

We can say TD Ameritrade platform is one of the best brokers in the US and also one of the famous forex brokers in the UK, covering every aspect of trading. One of the main highlights is, it offers commission free trades on options, stock ETFs. It offers excellent services including hands-on investment courses, portfolio building tutorials, high quality research tools and a wide range of no-trading fees and mutual funds. The research and educational tools offered by TD Ameritrade stand out by providing traders with a number of tools. Furthermore, its Thinkorswim trading platform is considered as one of the best available in the market. It also provides excellent customer service where traders’ problems are resolved in no time.

Please read: https://sinhmmo.net/2022/07/pros-and-cons-of-forex-trading.html